Mayors representing two politically-different communities recently spoke with one voice regarding the need for the state to re-commit to the success of local governments. Brookfield Mayor Steve Ponto and Madison Mayor Satya Rhodes-Conway distributed a joint Op Ed to the media throughout Wisconsin, calling for a reversal of decades of reduced state support for city and village government, and a recognition that cities and villages are critical to the state’s success. It’s a good read; take a look.

The State Needs to Re-Commit to Cities

By Brookfield Mayor Steven Ponto & Madison Mayor Satya Rhodes-Conway

The cities of Brookfield and Madison are different in many ways. In one the majority votes red, the other blue. One is a suburban enclave, mostly white and upper middle-class. The other is the state’s second largest city and has a more diverse mix of people and incomes.

As the mayors of these two communities, we may disagree on many issues, but we both firmly agree on this: The Wisconsin Legislature needs to re-commit to helping cities flourish. Thriving municipalities are crucial to Wisconsin’s long-term economic success. To compete nationally and globally Wisconsin needs high quality communities that can attract and retain talent and enterprise and spur job creation.

The state should increase its investment in cities because if cities are not doing well, neither is the state. We suggest three policy changes for accomplishing this: reversing cuts in state aid to cities, easing property tax levy limits, and allowing municipalities to create new revenue streams, such as a local sales tax, provided voters approve in a referendum.

Wisconsin’s cities and villages are home to:

- 72% of the state’s population

- 90% of the state’s commercial value

- 87% of the state’s manufacturing value

Most of the small businesses created in Wisconsin get their start in cities and villages.

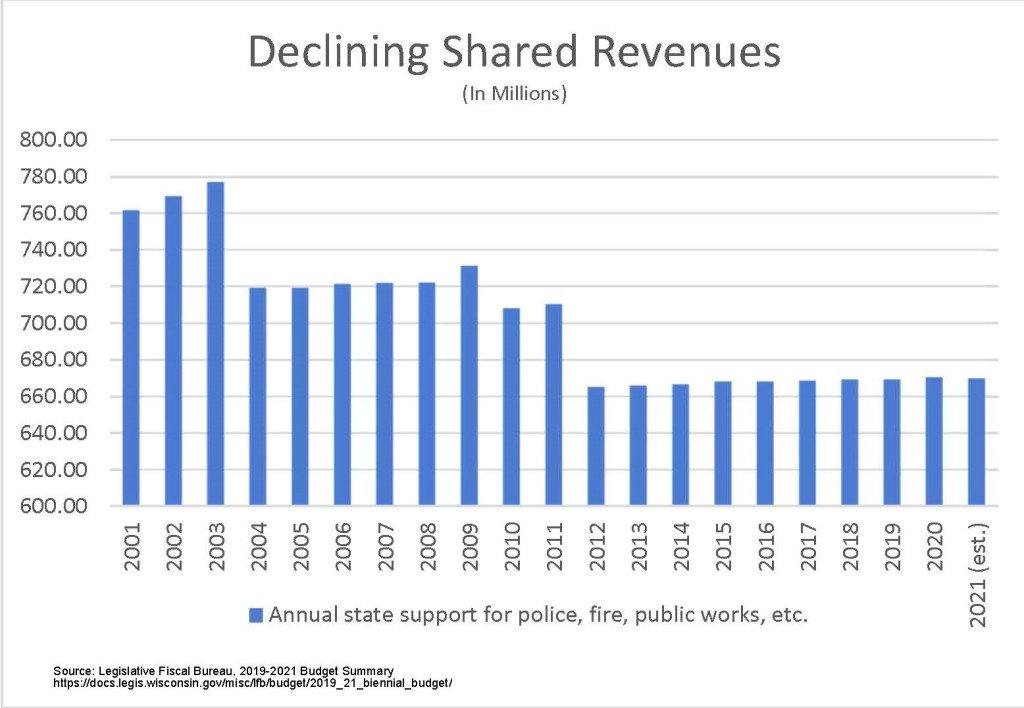

Yet, the state government continues to disinvest in cities. In the last two decades, under both political parties, the state’s financial commitment to cities has been on a steady downward trend. At the same time, the state tightly restricts the ability of municipalities to raise their own revenues to fund the services people and businesses expect.

The largest state aid program for municipalities, called shared revenue, has been cut incrementally by $94 million since 2003, a 12.3% reduction. In 2003, Madison received $9.2 million and Brookfield just over $1 million in shared revenue from the state. In 2021, Madison will receive $6.1 million and Brookfield just over $570,000. Meanwhile, the cost of providing services has, like everything else, increased substantially since 2003.

Unless these policies are changed, municipalities in Wisconsin will be unable to provide the same level and quality of local services that they have. Lower quality services will eventually lead people and businesses to locate in other states with more prosperous and attractive cities.

We call on the Legislature to use the state’s 2021-2023 budget to renew its partnership with municipalities by increasing its financial commitment to communities. We also urge the Legislature to ease the nation’s strictest property tax limits. Let municipal elected leaders have more control over local budgets and finances by providing flexibility on levy limits – perhaps by allowing communities experiencing little growth to increase their levy by at least the rate of inflation.

The Legislature should also expand local revenue options for municipalities to consider. The state can best help cities prosper, protect residents, and relieve over dependency on property taxes by giving communities other revenue options to pay for critical services like police, fire, streets, libraries, and parks. One obvious choice is to give communities the option of going to the voters with a referendum seeking permission to impose a local sales tax. While some communities like Brookfield would likely not pursue this option, other communities would.

We may not agree on much, but we both love our communities and we both know we need the state to begin partnering with its local governments. This can best be done by reinvesting in communities, easing the strict limits on property tax collections, and providing more local revenue options. A great state needs successful cities. The state Legislature must do more to help municipalities succeed.

###

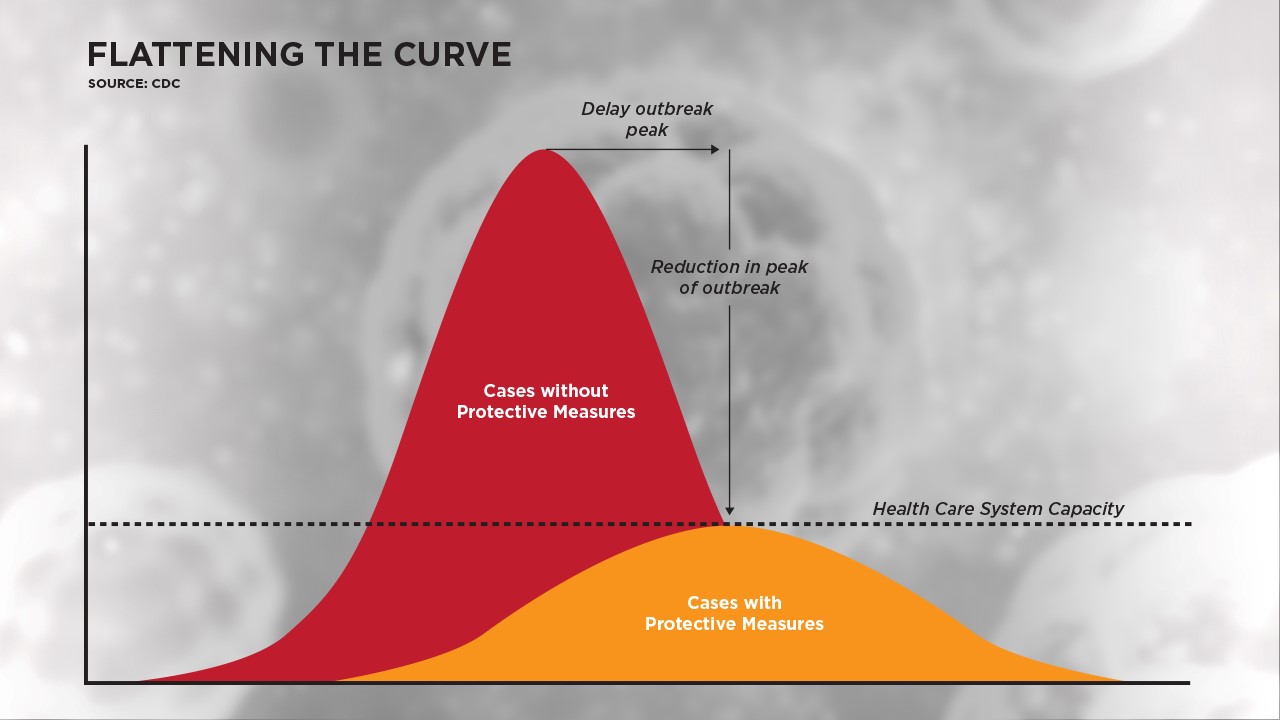

The Governor’s order, President Trump’s campaign and your work at the local level are all targeted at the same goal: flattening the curve. “Flattening the curve” means slowing down the spread of the Coronavirus to a rate that our hospitals, doctors and clinics can handle. If we don’t slow it down, there will quickly come a point where there are more people who need to be in the hospital than there are hospital beds available. Italy found out to its horror what happens when you don’t flatten the curve. People die in the corridors of hospitals as they wait their turn for a ventilator or other critical care.

The Governor’s order, President Trump’s campaign and your work at the local level are all targeted at the same goal: flattening the curve. “Flattening the curve” means slowing down the spread of the Coronavirus to a rate that our hospitals, doctors and clinics can handle. If we don’t slow it down, there will quickly come a point where there are more people who need to be in the hospital than there are hospital beds available. Italy found out to its horror what happens when you don’t flatten the curve. People die in the corridors of hospitals as they wait their turn for a ventilator or other critical care.

Wisconsin’s long road back to a well-maintained transportation system has begun. Yesterday the Wisconsin Department of Transportation announced the

Wisconsin’s long road back to a well-maintained transportation system has begun. Yesterday the Wisconsin Department of Transportation announced the